Taxable income band SG 20001 to 30000. For more information about or to do calculations involving income tax please visit the Income Tax Calculator.

How To Calculate Your 2013 Expatriate Individual Income Tax In China China Briefing News

Singapore income tax rates for year of assessment 2020.

. Taxable income band SG 1 to 20000. Value-Added Tax VAT. The countries that define their sales tax as a GST are Spain Greece India Canada Singapore and Malaysia.

Please refer to the infographic below to see how your chargeable income is being taxed. National income tax rates. This calculator is not suitable for persons liable to income tax USC and PRSI as a self-employed contributor For the status of married with two earners for the purposes of the calculation the salary figures of the spouse should be input separately.

You can deposit this challan with the State Bank of India SBI Reserve Bank of India RBI HDFC Bank ICICI Bank Indian Bank Indian Overseas Bank and other authorised banks. Malaysia Nepal Pakistan Singapore Sri Lanka UK. National income tax rates.

Your average tax rate is 215 and your marginal tax rate is 115. National income tax rates. Income Tax Calculator for AY 2023-24 FY 2022-23 AY 2022-23 FY 2021-22 AY 2021-22 FY 2020-21 to use for tax computation and to compare old vs new tax regime scheme for IT or Investment declaration with your employer.

That means that your net pay will be S66852 per year or S5571 per month. Easiest GST ready Accounting software. If you make S85200 a year living in Singapore you will be taxed S18348.

National income tax rates. Singapores personal income tax rates are progressive for tax residents. You can make an advance tax payment with the use of tax payment challan generated at the bank branches chosen by the Income Tax Department.

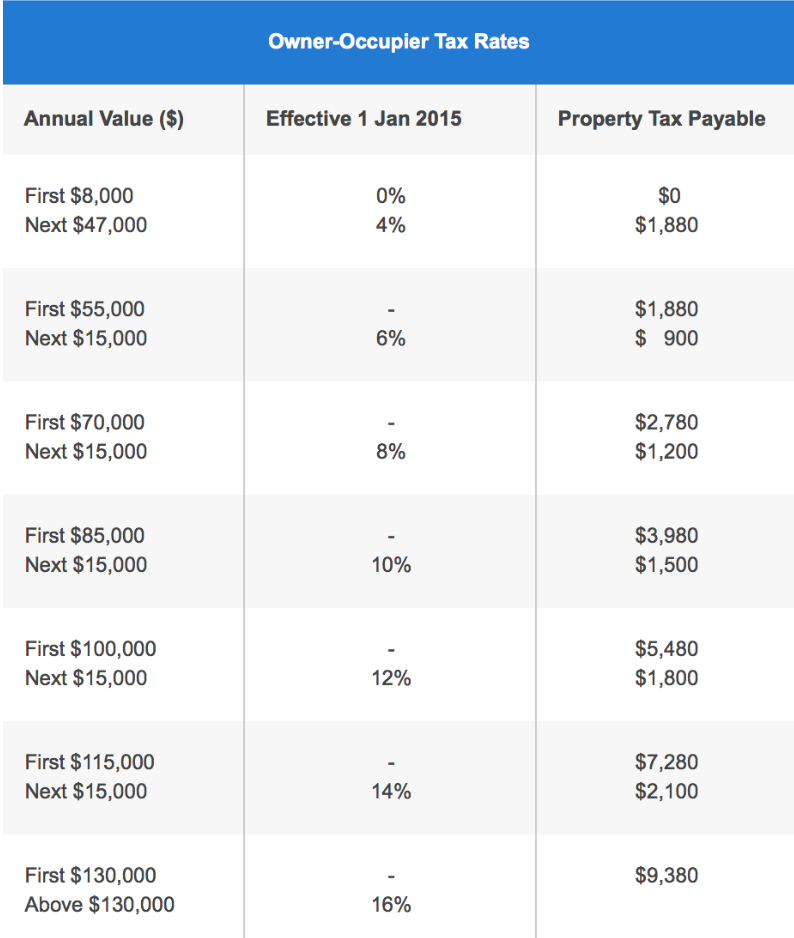

Taxable income band SG 40001 to 80000. Personal Income Tax Rate for Tax Residents. This means that higher-income earners are subjected to a higher tax rate with the maximum personal income tax rate at 22.

Taxable income band SG 30001 to 40000. This marginal tax rate means that your immediate additional income will be taxed at this rate.

Calculating Individual Income Tax On Annual Bonus In China Updates Dezan Shira Associates

Singapore Tax Rate Personal Individual Income Tax Rates In Singapore Updated

A Guide To Singapore Personal Tax

Singapore Individual Income Tax Filing For 2016

How To Calculate Foreigner S Income Tax In China China Admissions

Malaysia Personal Income Tax Calculator Malaysia Tax Calculator

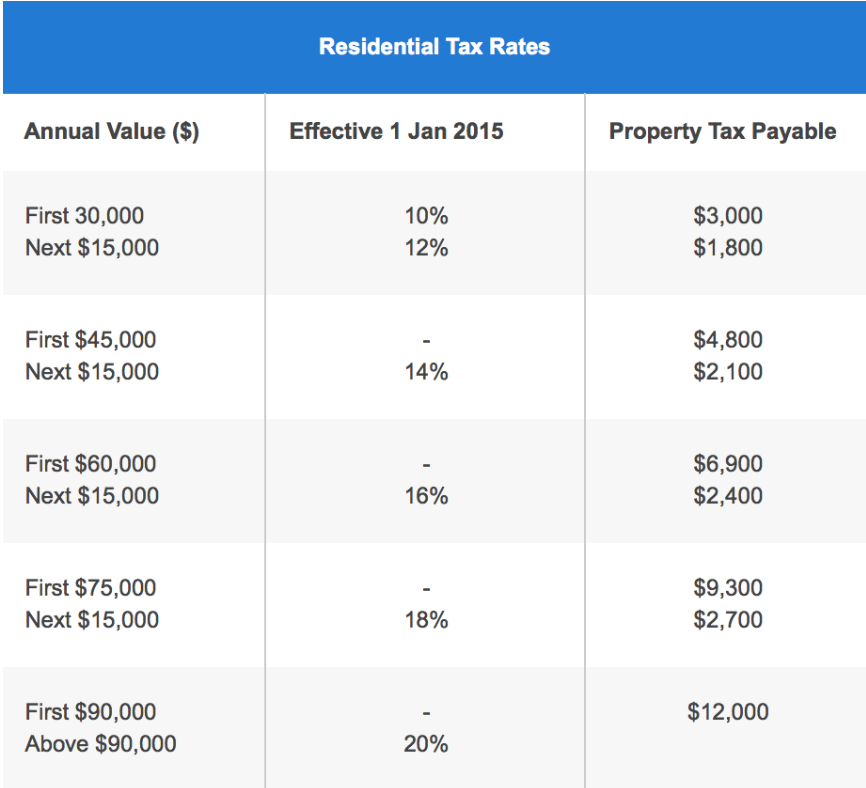

Property Tax For Homeowners In Singapore How Much To Pay Rebates Deadline

Excel Investment Singapore Iras Income Tax Calculator

Singapore Income Tax Calculator Corporateguide Singapore

How To Calculate Income Tax In Excel

Your Cheat Sheet Personal Income Tax In Singapore

Cukai Pendapatan How To File Income Tax In Malaysia

Donation Tax Calculator Giving Nus Yong Loo Lin School Of Medicine Giving Nus Yong Loo Lin School Of Medicine

Singapore Tax Calculator On Google Spreadsheet Just2me

Ease Of Doing Business Singapore Vs Malaysia Rikvin Pte Ltd

Property Tax For Homeowners In Singapore How Much To Pay Rebates Deadline

How To File Income Tax In Singapore And What You Need To Know

Niyet Etmek Yeterlik Ideal Garaj Tahmin Turist Tax Calculator Malaysia 2020 Upatreearts Org

What Is The Income Tax Slab In Singapore Quora